Why Understanding Boat Financing Options Matters

Boat Financing Options are the key to turning your dream of cruising Lake Texoma or Table Rock Lake into reality. Most people don’t have tens of thousands of dollars sitting in their bank account, which is why knowing your financing choices is essential before you start shopping for that Suncatcher pontoon or Skeeter fishing boat.

Quick Answer: Your Main Boat Financing Options

- Secured Boat Loans – Use the boat as collateral, typically offering the lowest rates (6-9% APR) and longest terms (up to 20 years)

- Unsecured Personal Loans – No collateral required, but higher rates (9-18% APR) and shorter terms (1-7 years)

- Dealer Financing – Convenient one-stop shopping, often bundling accessories like trailers

- Bank or Credit Union Loans – Leverage existing relationships, competitive rates for good credit

- Marine Lending Specialists – Industry expertise, flexible terms for various boat types

- Home Equity Loans – Lowest rates possible, but puts your home at risk

The average boat loan rate currently sits around 9.02% APR, though borrowers with excellent credit (740+) can secure rates as low as 8.03%. Loan terms typically range from 10 to 20 years, with down payments between 10-20% of the purchase price.

Here’s the reality: financing a boat isn’t much different from financing a car or home. Lenders look at your credit score, income, and debt-to-income ratio. Most want to see a credit score of 700 or higher for the best rates, though scores as low as 600 may still qualify with less favorable terms.

Whether you’re eyeing a G3 fishing boat for early morning trips on Lake Texoma or a Lowe pontoon for family gatherings at Table Rock Lake, understanding your financing options helps you make a confident purchase decision. The right loan can mean the difference between settling for a boat that’s “good enough” and getting the vessel that’s perfect for your needs.

Understanding the Types of Boat Loans

When we explore Boat Financing Options, we typically encounter a few main types of loans, each with its own advantages. The most common are secured loans, where the boat itself acts as collateral, and unsecured personal loans, which don’t require collateral but come with different terms. We also have specialized avenues like dealer financing and marine lenders, who understand the unique aspects of boat ownership. Generally, boat loan terms can stretch from 10 to 20 years, with initial down payments usually falling between 10% and 20% of the purchase price. Whether you’re looking at a sleek Skeeter fishing boat for Lake Texoma or a family-friendly Suncatcher pontoon for Table Rock Lake, understanding these options is your first step.

Secured vs. Unsecured Loans

The fundamental difference between secured and unsecured loans lies in collateral. A secured boat loan uses the boat you’re purchasing as collateral. This means if you, unfortunately, default on your payments, the lender has the right to repossess the boat. Because the lender has this security, secured loans typically offer lower interest rates and longer repayment terms—sometimes up to 20 years. This makes them an excellent choice for financing a new G3 fishing boat or a Lowe pontoon, allowing us to spread out the cost over a manageable period.

On the other hand, an unsecured personal loan does not require any collateral. You’re essentially borrowing based on your creditworthiness alone. While this offers more flexibility (the lender doesn’t need to know the specifics of the boat), it also comes with higher interest rates and shorter repayment terms, usually between 1 to 7 years. If you’re looking to finance an older boat or a smaller purchase where you prefer not to use the boat as collateral, an unsecured loan might be an option. However, missing payments on an unsecured loan can lead to severe consequences, including damage to your credit and legal action.

Where to Get a Boat Loan: Dealers, Banks, and Marine Lenders

When considering where to secure your boat loan, we have several reliable avenues:

- Dealer Financing: This is often the most convenient option. As a dealership, we at Blackbeard Marine work with a network of lenders specializing in marine financing. This means you can handle the entire purchase and financing process in one place, streamlining your experience. Dealers are motivated to help you get approved and can often offer competitive rates or special promotions on brands like Skeeter, G3, or Blazer Bay.

- Banks: Your local bank, where you might already have a relationship, can be a great source for boat loans. They often offer competitive rates, especially if you have a strong banking history with them.

- Credit Unions: These member-owned financial institutions are known for offering lower interest rates and more flexible terms than traditional banks, particularly for those with good credit. Some credit unions may also be more willing to work with individuals who have less-than-perfect credit, especially for secured loans.

- Specialized Marine Lenders: These lenders focus exclusively on boat financing and possess in-depth knowledge of the marine industry. They understand the nuances of boat values, types, and the unique needs of boat owners. This specialization can lead to more flexible terms and a smoother approval process, especially for larger or more unique vessels. The National Marine Lenders Association is an excellent resource if you want to explore this option further.

Alternative Boat Financing Options to Consider

Beyond traditional boat loans, a couple of other options might suit your financial situation:

- Home Equity Loans or Lines of Credit (HELOC): If you own a home and have significant equity, a home equity loan or HELOC can offer very attractive interest rates, often lower than those for boat-specific loans. This is because your home acts as collateral, which is a very secure asset for lenders. However, this also means your home is at risk if you default. It’s a serious decision, and we encourage you to weigh the benefits of lower interest against the significant risk involved.

- Paying with Cash: While the idea of owning a boat outright with cash is appealing, it’s not always the smartest financial move. Paying cash avoids interest and monthly payments, offering financial freedom. However, it ties up a significant amount of capital that could otherwise be invested or kept liquid for emergencies. For many, financing allows them to maintain healthy cash reserves and enjoy their Blazer Bay or Lowe boat without depleting their savings.

Qualifying for a Boat Loan: What Lenders Look For

When we apply for a boat loan, lenders are primarily looking for assurance that we can comfortably repay the loan. They assess several key factors to determine our creditworthiness and the terms they’re willing to offer.

Typical Interest Rates and Loan Terms

The interest rate we qualify for is heavily influenced by our credit score. As of the second quarter of 2025, the average boat loan rate is around 9.02%. However, this rate can fluctuate significantly based on our credit profile:

- Excellent and Very Good Credit (740+): We can expect an average APR of 8.03%.

- Good Credit (670 – 739): The average APR moves up to 9.78%.

- Fair and Poor Credit (669 and below): We might see average APRs around 11.6% or higher.

Loan terms for boat financing are quite flexible, often ranging from 12 months up to 240 months (20 years), especially for larger loan amounts. This allows us to tailor our monthly payments to fit our budget. Most boat loans come with fixed interest rates, meaning our monthly payment remains consistent throughout the loan term, providing predictability. While variable rates exist, fixed rates are generally preferred for stability. For more detailed insights into how rates are determined, you can explore More info about boat loan rates.

The Importance of a Down Payment

A down payment is a crucial component of boat financing. While a typical boat loan down payment is between 10% to 20% of the boat’s cost, putting down more can significantly benefit us:

- Avoiding Being “Upside-Down”: Boats, like cars, depreciate. A substantial down payment helps ensure we don’t owe more on the boat than it’s worth, known as being “upside-down” on the loan. This gives us financial flexibility if we ever need to sell the boat.

- Lowering Monthly Payments: A larger down payment means we’re financing less, which directly translates to lower monthly payments and less interest paid over the life of the loan.

- Showing Financial Stability: A significant down payment demonstrates to lenders that we are financially responsible and serious about our purchase, potentially leading to more favorable loan terms.

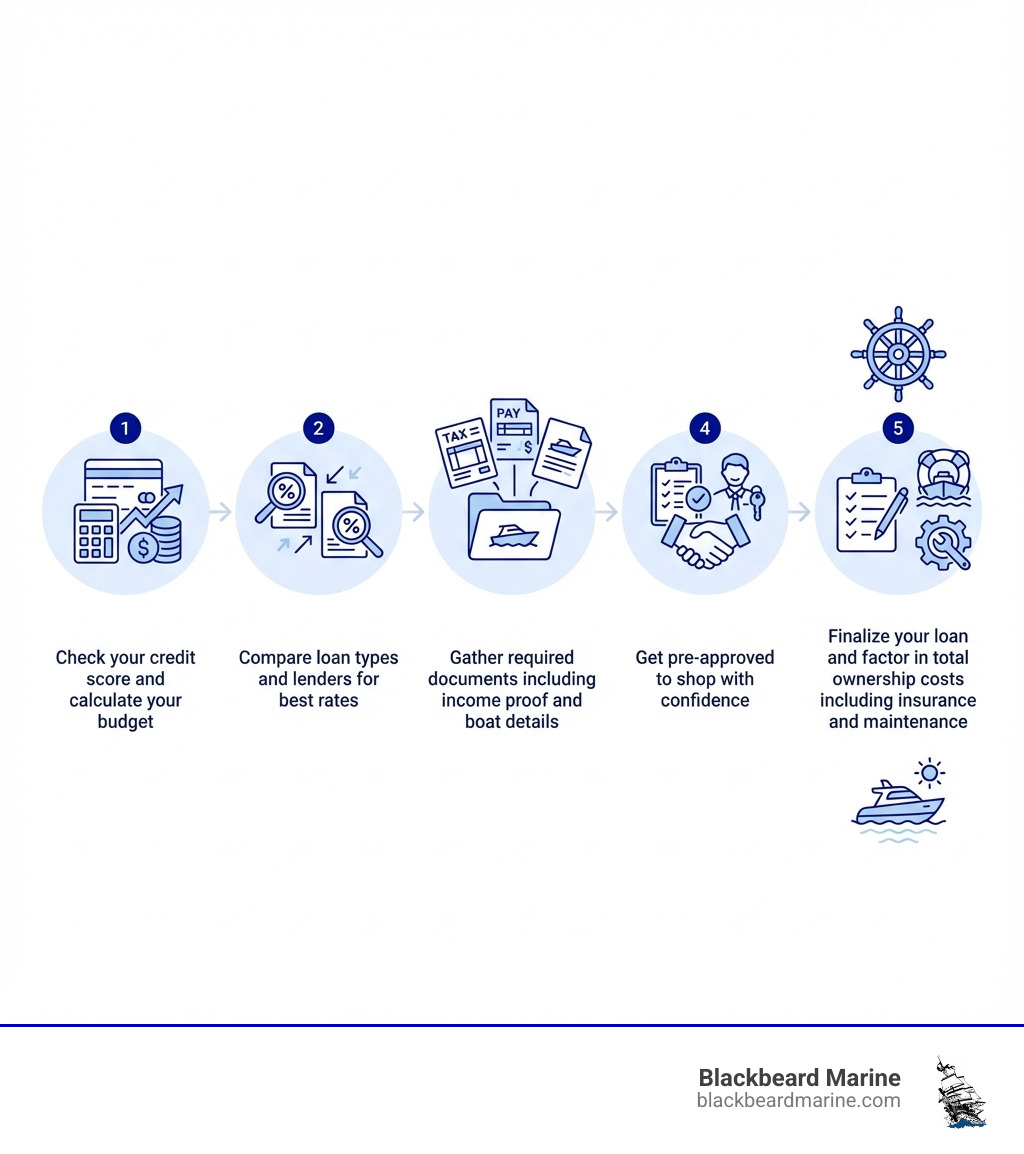

The Application and Approval Process Explained

Starting on the boat loan application journey might seem daunting, but we’re here to guide you through it. It’s a straightforward process designed to ensure you get the best possible financing for your dream boat.

Getting Pre-Approved for Your Boat Loan

One of the smartest moves we can make is getting pre-approved for a boat loan before we even start seriously shopping. Here’s why:

- Shopping with Confidence: Pre-approval gives us a clear budget, so we know exactly how much we can afford. This allows us to focus on boats within our price range, whether it’s a G3 fishing boat or a Suncatcher pontoon, without falling in love with something unattainable.

- Setting a Firm Budget: With a pre-approval in hand, we have a firm number. This empowers us during negotiations, as we’re not guessing what we can spend.

- Streamlining the Purchase Process at the Dealership: When we arrive at Blackbeard Marine with a pre-approval, the purchase process becomes much smoother and faster. We can focus on the exciting part – choosing our boat – while knowing the financial side is largely sorted.

- How Pre-Approvals Work: We’ll provide our financial information (income, credit history, assets, etc.) to a lender. They’ll review it and, if approved, give us an offer for a loan amount and estimated interest rate. While not a final commitment, it’s a powerful tool for informed shopping.

Financing a Used Boat: Special Considerations

Financing a used boat, such as a pre-owned Lowe or Seaark, is definitely possible, but it comes with a few extra considerations compared to financing a new vessel:

- Lender Age Restrictions: Some lenders have age limits on the boats they will finance. For example, some may only finance boats less than 20 or 25 years old. This is something we’ll need to confirm with our chosen lender.

- Marine Survey Requirement: For most used boats, especially larger or older models, lenders will require a marine survey. This is similar to a home inspection and appraisal rolled into one. A qualified marine surveyor will inspect the boat’s condition, equipment, and structural integrity, and provide an assessment of its market value. This protects both us and the lender by ensuring the boat is sound and worth the loan amount.

- Valuing the Vessel: Lenders use third-party valuation guides to ensure the purchase price aligns with the boat’s market value. We can also use tools like the NADA Guides Boat Value Online Tool to check the value of the boat we’re considering. This helps us negotiate a fair price and ensures the loan amount is appropriate for the asset.

Navigating Your Boat Financing Options and Associated Costs

Choosing the right Boat Financing Options can feel like charting a course through unfamiliar waters, but we’re here to help you steer. It’s not just about the loan itself; it’s about understanding the entire financial picture.

| Financing Option | Pros | Cons | Best For |

|---|---|---|---|

| Dealer Financing | Convenience; One-stop shopping; Special promotions; Knowledge of specific boat brands (Skeeter, G3) | May have fewer lender options than shopping independently; Rates might not always be the absolute lowest | Buyers seeking ease and speed; Those wanting to bundle accessories; First-time buyers who appreciate guidance |

| Bank/Credit Union | Competitive rates for established customers; Existing relationship can simplify process | May not specialize in marine loans; Less flexibility for accessories; Might have stricter age limits for used boats | Borrowers with strong credit and existing banking relationships; Those seeking a direct, traditional loan |

| Marine Lender | Deep industry expertise; Flexible terms for unique boats; Understanding of marine-specific needs | May require more documentation (e.g., marine survey for used boats); Can be less convenient than dealer financing if not integrated | Buyers of specialized or higher-value boats (e.g., larger Blazer Bay models); Those financing older or unique used vessels; Buyers wanting expert marine financial advice |

Comparing Dealer vs. Bank Boat Financing Options

When we compare dealer financing to options from banks or credit unions, it boils down to convenience versus flexibility.

At Blackbeard Marine, we offer dealer financing, which provides unparalleled convenience. We’ve established relationships with various marine lenders, allowing us to offer competitive rates and terms right here at our Kingston, OK, Branson, MO, or Lake Texoma locations. This one-stop shopping approach means you can pick out your Suncatcher pontoon or Lowe fishing boat, arrange the financing, and even discuss bundling accessories like trailers or outboard motors all in one visit. This integrated approach often results in a smoother, faster closing process.

Banks and credit unions, on the other hand, offer their own advantages. If we have a strong, long-standing relationship with our bank, we might qualify for favorable rates. However, they might not specialize in marine loans, and their processes might be less custom to the unique aspects of boat ownership. While they offer flexibility in terms of choosing our own lender, they might not be able to bundle items like a new G3 outboard motor into the loan as easily as a dealership can.

Budgeting for the Total Cost of Ownership

Financing the purchase of your dream Blazer Bay or Skeeter boat is just the first step. To truly enjoy your vessel on Table Rock Lake or Lake Texoma, it’s vital to budget for the total cost of ownership. Beyond our monthly loan payment, we need to consider:

- Insurance: Lenders almost always require comprehensive boat insurance to protect their collateral. Premiums vary based on the boat’s value, type, where it’s stored, and our boating history. Taking a boating safety course can sometimes even help lower our insurance rates!

- Maintenance: Boats require regular maintenance, just like cars. This includes routine engine servicing, cleaning, winterization, and occasional repairs. These costs can vary significantly depending on the boat’s size and complexity.

- Registration & Fees: State registration, titling, and other local fees are recurring costs associated with boat ownership.

- Storage/Docking: If we don’t have space to keep our boat at home, we’ll need to factor in costs for storage, whether it’s a dry stack, a slip at a marina on Table Rock Lake, or a covered storage unit near Lake Texoma.

- Fuel: Ah, the cost of adventure! Fuel consumption varies greatly by boat type and usage. A high-performance Skeeter will consume more fuel than a leisurely Suncatcher pontoon.

Ignoring these additional costs can quickly turn a dream into a financial headache. A comprehensive budget ensures we can enjoy our boat without unexpected stress.

Estimating Your Monthly Payment

Understanding what our monthly boat payment will look like is crucial for budgeting. While we can use online loan calculators, the concept is simple: our payment is influenced by three main factors:

- Principal: This is the total amount we’re borrowing after our down payment. The higher the principal, the higher the monthly payment (assuming other factors are constant).

- Interest Rate: As discussed, this is heavily dependent on our credit score and the lender. A lower interest rate means less money paid overall and a lower monthly payment.

- Loan Term: This is the length of time we have to repay the loan, typically in months. A longer loan term results in lower monthly payments but means we pay more in total interest over time. Conversely, a shorter term means higher monthly payments but less interest paid.

We can use a boat loan payment calculator to play with these variables and find a payment that fits our budget. For more detailed information, check out our guide on Learn more about loan rates.

Managing Your Loan and Future Possibilities

Once we’ve secured our boat loan and are enjoying our G3 or Suncatcher, it’s important to understand how to manage the loan responsibly and what options are available to us down the line.

Refinancing Your Existing Boat Loan

Life changes, and so do interest rates. If we find ourselves in a better financial position or market rates have dropped, refinancing our existing boat loan could be a smart move.

- When to Refinance: We might consider refinancing if current interest rates are significantly lower than our original loan’s rate, if our credit score has improved dramatically, or if we want to change our loan term (either shorten it to pay less interest or lengthen it to reduce monthly payments).

- Potential Savings: Refinancing can lead to substantial savings on interest over the life of the loan, freeing up funds for more adventures on Lake Texoma or Table Rock Lake!

- Process Overview: Similar to the initial application, we’ll apply to a new lender (or our current one) for a new loan to pay off the old one. The new loan will come with new terms and interest rates. You can find More about Boat Loans and refinancing options.

What Happens if You Default on a Loan?

It’s an unpleasant thought, but it’s crucial to understand the implications of defaulting on a boat loan. A default occurs when we fail to make our payments as agreed upon in the loan contract.

- Lender Actions: For secured loans, the most immediate consequence is the risk of repossession. The lender can legally seize the boat to recover their losses. For unsecured loans, they might pursue legal action, which could lead to wage garnishment or property liens.

- Impact on Your Credit Report: Defaulting severely damages our credit score. This makes it incredibly difficult to obtain any form of credit in the future, from car loans to mortgages, and can impact insurance rates and even employment.

- Legal Consequences: Lenders can sue us for the outstanding balance, plus any fees and legal costs.

- Importance of Communication: If we anticipate difficulty making a payment, the absolute best thing to do is communicate with our lender immediately. They may be willing to work with us on a temporary payment plan or offer alternatives to avoid default. Ignoring the problem will only make it worse.

Frequently Asked Questions about Boat Loans

Can I include a trailer or outboard motor in my boat loan?

Yes, absolutely! When we finance a new G3, Lowe, Skeeter, Seaark, or Blazer Bay boat, it’s very common to include the cost of a trailer and any outboard motors in the total loan amount. This allows us to finance the entire package with one convenient monthly payment, rather than needing separate financing for these essential components.

What credit score do I need for a boat loan?

While requirements vary by lender, most mainstream marine lenders prefer a credit score of 700 or higher to qualify for the best rates and terms. However, it’s still possible to get a boat loan with a credit score in the upper 600s, though we might encounter slightly higher interest rates or be asked for a larger down payment. Some lenders may even consider scores as low as 600, particularly for secured loans, but this will typically come with less favorable terms.

How long are typical boat loan terms?

Boat loan terms are quite flexible and generally longer than car loans. We commonly see terms ranging from 10 to 20 years (120 to 240 months), especially for larger loan amounts. For smaller, trailerable boats, terms might be shorter, perhaps 5 to 7 years. The exact term we qualify for will depend on factors like the loan amount, the age and type of the boat, our credit score, and our chosen lender.

Conclusion: Set Sail on Your Ownership Journey

Navigating Boat Financing Options might seem like a lot to take in, but with the right knowledge and preparation, we can make the process smooth and enjoyable. We’ve explored the different types of loans, what lenders look for, how to budget for total ownership costs, and even what to do if we need to refinance.

The dream of owning a Blazer Bay fishing boat cutting through the waves on Lake Texoma or spending serene afternoons on a Suncatcher pontoon at Table Rock Lake is within reach. By understanding your financing choices, getting pre-approved, and budgeting wisely, you’ll be well-prepared to make an informed decision.

At Blackbeard Marine, we’re dedicated to helping you find the perfect boat and the financing solution that fits your lifestyle. Our expertise in high-performance wake, surf, pontoon, and fishing boats, combined with flexible financing options, means we’re here to support your entire journey, from selection to maintenance. Don’t let financing be a barrier to your on-water adventures.

Ready to make your boating dreams a reality? Get started with Boat Financing with Blackbeard Marine today, and let us help you set sail!