Why Used Boat Financing Opens Waters of Opportunity

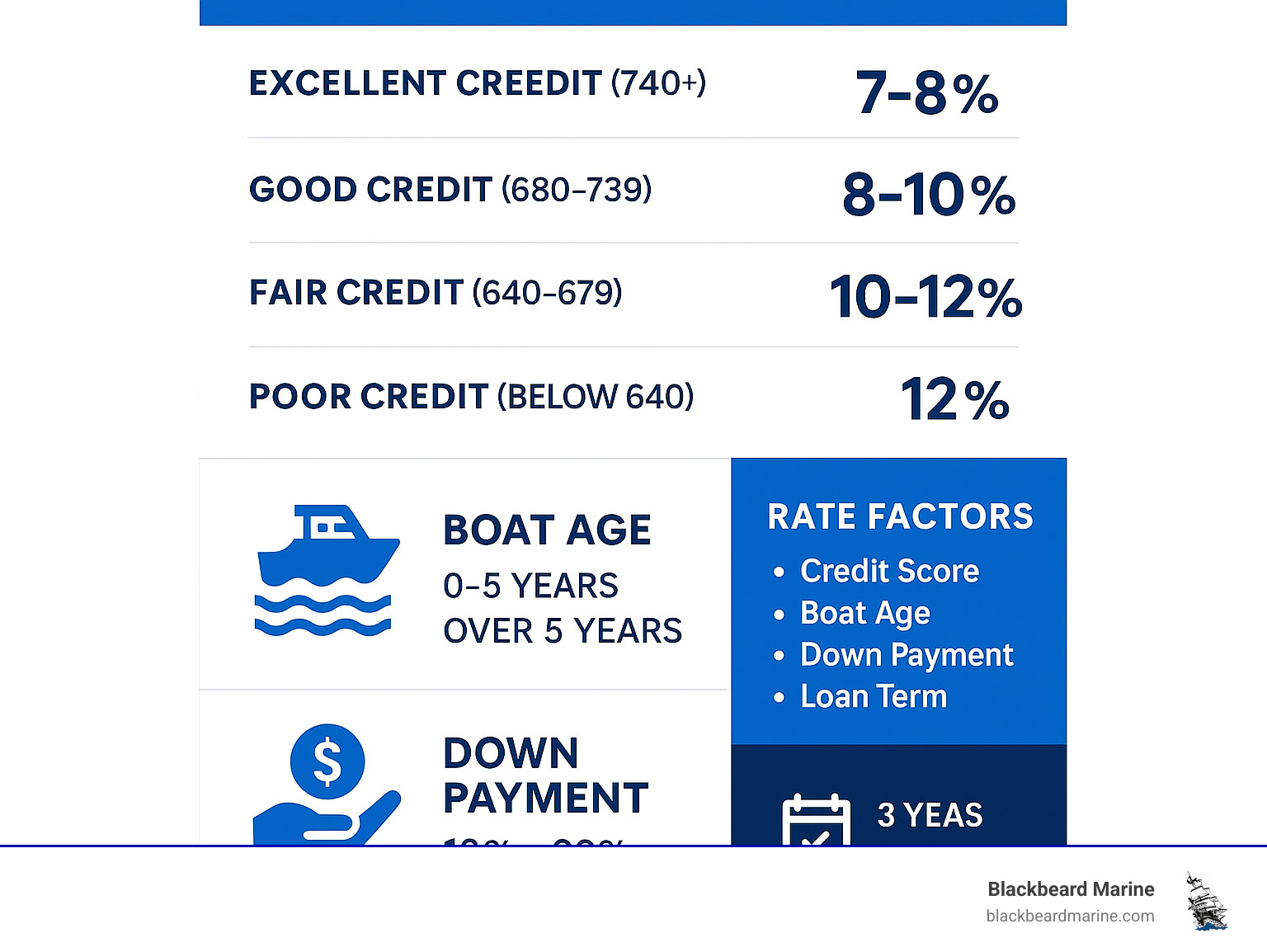

Used boat loan rates typically range from 7% to 12% APR, depending on your credit score, the boat’s age, and loan terms. Here’s what you need to know:

Current Used Boat Loan Rate Ranges:

- Excellent Credit (740+): 7-8% APR

- Good Credit (680-739): 8-10% APR

- Fair Credit (640-679): 10-12% APR

- Poor Credit (below 640): 12%+ APR

Key Rate Factors:

- Boat age and condition

- Your credit score

- Down payment amount

- Loan term length

The dream of cruising Lake Texoma in a Skeeter bass boat or hosting gatherings on a Suncatcher pontoon at Table Rock Lake is within reach. Used boats offer an affordable entry point into ownership, with slower depreciation making financing more attractive.

Unlike new boats that lose significant value instantly, used boats have already absorbed their steepest depreciation. This leads to better loan-to-value ratios and more flexible financing terms.

Whether you’re eyeing a G3 fishing boat or a Lowe pontoon, understanding used boat financing can save you thousands and get you on the water sooner.

Understanding the Landscape of Used Boat Loan Rates

Financing a pre-owned boat like a Suncatcher pontoon for trips on Table Rock Lake differs from buying new. Used boat loan rates are typically 1-2% higher in APR because lenders view used boats as slightly riskier investments due to potential repairs and age. However, this can work in your favor.

A G3 fishing boat you’re considering has already taken its biggest depreciation hit. New boats lose value the moment they leave the dealership, but a used boat’s value is more stable. This positively impacts your Loan-to-Value (LTV) ratio—the amount you borrow compared to the boat’s worth.

Most lenders prefer an LTV of 85% or lower, and a well-priced used Skeeter or Lowe boat often makes this target easier to hit. For detailed information about current market rates, check out our guide on Best Boat Loan Rates.

Your debt-to-income ratio (DTI) is another key factor. This measures your monthly debt payments against your gross monthly income. Lenders prefer a DTI of 30-35% or lower to ensure you can comfortably handle payments.

How Your Credit Score Shapes Your Rate

Your credit score is a primary factor in determining your used boat loan rates.

- Excellent Credit (740+): You are in a prime position. Lenders offer their best rates, typically starting around 7-8% APR, because you’re seen as a low-risk borrower.

- Good Credit (680-739): You’re still in a strong position and will find favorable options, usually in the 8-10% APR range. Most lenders consider a score of 660 or higher as good territory for boat financing.

- Fair Credit (640-679): Your options might be more limited, with rates between 10-12% APR. However, that dream Seaark fishing boat is still within reach.

- Poor Credit (below 640): Financing is still possible, though it requires more effort. Some lenders specialize in working with scores as low as 550-600, but you’ll face higher rates (12% APR and above) and may need a larger down payment.

Blackbeard Marine works with multiple lenders to find solutions that fit your needs. Learn more about our comprehensive boat financing services.

Key Factors Beyond Credit That Influence Used Boat Loan Rates

While credit is crucial, other factors also influence your rate.

- Boat age plays a huge role. A 5-year-old Blazer Bay will likely qualify for better rates than a 15-year-old model. Lenders often have age limits, typically not financing boats older than 10-20 years.

- Boat value and type matter. Lenders use resources like the NADA Guides Boat Value Online Tool to determine fair market value. A well-maintained Suncatcher pontoon with strong resale value will qualify for better rates.

- Loan term length involves a trade-off. Shorter terms often have lower interest rates but higher monthly payments. Longer terms offer lower monthly payments but result in more total interest paid.

- Down payment size is critical. A substantial down payment, typically 10-20%, reduces the lender’s risk and can lead to better rates and terms.

- The depreciation’s impact is less severe on used boats. A Lowe fishing boat has already weathered its steepest value decline, making its worth more stable and predictable for lenders.

Navigating Loan Terms and Down Payments

You’ve found the perfect used G3 fishing boat for Lake Texoma; now it’s time to steer the financing. Understanding loan terms and down payments is key to making it yours without breaking the bank.

Lenders offer flexible terms for used boats, typically ranging from 5 to 20 years. A shorter loan means higher monthly payments but less interest paid overall. A longer loan provides more manageable monthly payments but costs more in total interest.

Amortization means that while more of your early payments go toward interest, you pay down more of the principal boat cost over time.

Most lenders expect a down payment between 10% and 20% of the purchase price. While some zero-down options exist, putting money down is a smart move that can improve your interest rate. If you’re upgrading, consider how to Trade-In or Sell Your Boat to increase your down payment.

Remember to budget for additional fees, such as origination, documentation, title, registration, and potentially a marine survey for older boats.

Decoding Loan Terms: How Long Can You Finance a Used Boat?

Choosing your loan term is a critical decision that impacts your budget and total cost.

Short-term loans (5 to 7 years) come with lower interest rates and get you debt-free faster, but monthly payments are higher. This is a great option if you want to own your Lowe pontoon outright as quickly as possible.

Long-term loans (10 to 20 years) offer lower monthly payments, making it easier to afford a spacious Suncatcher pontoon for family trips to Table Rock Lake. The trade-off is paying more in total interest. Lenders often favor longer terms as they keep payments manageable, reducing default risk.

Before deciding, use a boat loan calculator to see how different terms affect your monthly payment and total interest, helping you find the right balance.

The Upfront Cost: Down Payments and Hidden Fees

A down payment is your best friend in boat financing. Standard down payment percentages are 10% to 20%, but a larger down payment can significantly improve your financing terms.

A larger down payment not only reduces your loan amount but can also lower your interest rate. Lenders view you as less risky when you have more equity in the boat from the start.

Be aware of fees that can be overlooked. Origination fees cover loan processing, documentation fees handle paperwork, and title and registration fees are required by the state. For older or high-value used boats, a marine survey (an independent inspection) may be required to confirm the boat’s condition and value.

When you see ads for very low rates, look closely. They may require short terms with high payments or exclude fees. Always check the Annual Percentage Rate (APR), which includes the interest rate and most fees, to understand the true cost of the loan.

The Application Process: From Pre-Approval to On the Water

The application process for a used boat loan is your gateway to owning that Blazer Bay fishing boat. Start by setting a realistic budget that covers the purchase price, insurance, maintenance, and fuel.

While formal pre-approvals are less common than in mortgages, many lenders can pre-qualify you based on your financial profile. This strengthens your position when you’re ready to make an offer on a Skeeter or G3.

Getting pre-qualified shows sellers you’re a serious buyer and makes the process at Blackbeard Marine smoother. For post-purchase support, we offer comprehensive Service and Parts to keep your boat in top condition.

Where to Find the Best Used Boat Loan Rates

Shopping for used boat loan rates is like exploring different fishing spots—you want to check several locations for the best opportunity.

- Dealership financing is often the most convenient. At Blackbeard Marine, our network of marine financing specialists can secure competitive rates and handle all the paperwork for your Suncatcher pontoon or Seaark fishing rig, getting you on Table Rock Lake faster.

- Specialized marine lenders focus exclusively on boat financing and often work with older vessels that traditional banks might decline. They understand the unique aspects of financing a well-maintained, 10-year-old Lowe.

- Banks and credit unions can offer competitive rates, especially if you have an existing relationship. Credit unions are known for member-focused service and favorable terms.

- Online lenders provide convenience and allow you to compare multiple offers quickly. Services like Find a Lender For Boat Financing can connect you with various options.

The lowest advertised rate isn’t always the best deal. Consider the APR, loan terms, fees, and the lender’s reputation.

What You’ll Need: A Used Boat Loan Application Checklist

Organizing your documents beforehand will streamline the application process.

- Proof of income: Recent pay stubs, W-2s, or tax returns to show you can handle monthly payments.

- Personal identification and bank statements: To verify your identity and financial stability.

- Boat purchase agreement: Outlines the price and terms of the sale for your chosen G3 or Skeeter.

- Hull Identification Number (HIN): The boat’s unique 12-character code, required for financing and registration.

- Marine survey report: A comprehensive inspection required by many lenders for older or high-value used boats to assess condition and value.

- Proof of insurance: Required before the loan is funded, as the boat serves as collateral.

Having these documents ready will speed up your application, getting you out on the waters of our Fishing Boat Missouri territory sooner.

Weighing Your Options: Pros, Cons, and Alternatives

When dreaming of boating on Lake Texoma or Table Rock Lake, a key decision is whether to buy a new or used boat. Understanding the trade-offs will help you make the best financial choice.

| Feature | Financing a New Boat | Financing a Used Boat |

|---|---|---|

| Cost | Higher initial purchase price | Lower initial purchase price |

| Interest Rate | Generally lower (less risk for lender) | Generally higher (more risk for lender) |

| Depreciation | Rapid in the first few years | Slower, as initial depreciation has occurred |

| Warranty | Full manufacturer’s warranty | Limited or no warranty (depending on age) |

| Maintenance | Lower initial maintenance, predictable costs | Potentially higher repair costs, less predictable |

Why financing a used boat often makes sense: The primary advantage is the lower upfront cost, making a Suncatcher pontoon or Skeeter bass boat more attainable. Your investment also holds its value better because the boat has already taken its biggest depreciation hit. You’ll also find a wider selection in your budget, from a larger G3 fishing boat to a feature-rich Lowe pontoon, with no manufacturing delays.

The trade-offs to consider: Used boat loan rates are typically 1-2% higher. Older boats may require more maintenance, and most don’t have a manufacturer’s warranty, though quality brands like Seaark and Blazer Bay are built for reliability. A marine survey may also be required, adding a small upfront cost.

When new boat financing shines: New boats qualify for the lowest interest rates and come with a full warranty and the latest technology. This is the best path if you want to customize your boat or have the newest features.

The new boat reality check: New boats come with a premium price, rapid initial depreciation, and higher insurance costs. You may also face long waits for delivery.

Beyond traditional boat loans: If a standard loan isn’t right for you, consider alternatives. Personal loans are flexible but have higher rates and shorter terms. A home equity loan or HELOC may offer lower rates, but your home serves as collateral. For occasional boaters, renting or leasing eliminates financing, storage, and maintenance costs entirely.

The right choice depends on your budget and boating habits. Whether you’re browsing Boat Buying Sites or searching for Wakeboard Boats Oklahoma, understanding all your options is key.

Frequently Asked Questions about Used Boat Loans

What is a good interest rate for a used boat loan?

A good used boat loan rate depends on your financial profile and the boat’s age. Buyers with excellent credit (740+) can expect rates around 7-8% APR. Those with good credit (680-739) often find rates in the 8-10% range. Scores below 640 may see rates of 12% or higher. A newer used boat, like a three-year-old Suncatcher pontoon, will typically qualify for better rates than a fifteen-year-old model.

Can I get a used boat loan with bad credit?

Yes. While many lenders prefer credit scores above 680, some specialized marine lenders work with borrowers with scores as low as 550-600. Be prepared for higher interest rates and stricter terms, such as a larger down payment (20% or more). Lenders will also closely review your income stability and debt-to-income ratio. This path still allows you to build equity in a Blazer Bay or Seaark while enjoying time on Table Rock Lake.

Is the interest on my boat loan tax-deductible?

In some cases, yes. If your boat qualifies as a second home, the interest on your loan may be tax-deductible. To qualify, the boat must have a sleeping area, a galley (kitchen), and a head (toilet). Many larger pontoons, like certain Suncatcher models, and cabin cruisers meet these requirements. Always consult with a qualified tax professional to confirm your specific situation and eligibility for this deduction.

Your Voyage to Ownership Starts Here

The waters of Lake Texoma and Table Rock Lake are calling. Whether you dream of a G3 fishing boat, a spacious Suncatcher pontoon, or a rugged Seaark, used boat ownership is more accessible than you might think.

Understanding used boat loan rates is the key. While rates for pre-owned vessels are typically in the 7% to 12% APR range, used boats hold their value better because they have already absorbed their steepest depreciation.

Your credit score is the most significant factor, but the boat’s age, your down payment, and the loan term also shape your final rate. The financing process is manageable when you know what to expect and have your documents ready, from income verification to the Hull Identification Number.

At Blackbeard Marine, we are passionate about getting you on the water in a quality used boat that fits your dreams and budget. Our team understands marine financing and is here to guide you through the process.

Your journey starts now. Explore our flexible boat financing options and browse the exceptional selection in our Inventory. From proven Skeeter bass boats to family-friendly Lowe pontoons, we have the vessel that will turn your boating dreams into lasting memories.

The water is waiting. Let’s get you there.

One Response