Why Understanding Surf Boat Financing Options is Crucial Before You Buy

Surf boat financing lets you own your dream wake boat without draining your savings. Most buyers use loans of 10 to 20 years, with interest rates from 6% to 10% based on credit.

Quick Answer: Your Surf Boat Financing Options

- Secured boat loans: Use the boat as collateral for lower rates (6-9%)

- Loan terms: Typically 10-20 years for boats over $50,000

- Down payment: Usually 10-20%, though no-deposit options exist

- Credit requirements: Most lenders prefer 675+ credit scores

- Monthly payments: Vary based on loan amount, term, and interest rate

Surf boats often cost $150,000 to $350,000, with monthly payments from a few hundred to over $1,000. A key factor to consider is that boat loans can extend longer than the boat’s expected lifespan, which impacts your financial decision.

Whether you want a Suncatcher pontoon for family fun on Lake Texoma or a high-performance G3 for fishing trips on Table Rock Lake, understanding financing is key to making a smart choice for your budget.

At Blackbeard Marine, we’ve helped countless families steer this process. This guide covers everything from loan terms and rates to the risks of long-term financing, helping you avoid turning a dream into a financial nightmare.

Understanding Surf Boat Loan Fundamentals

Most surf boat loans are secured loans, meaning your new Suncatcher or G3 boat serves as collateral. This is similar to a car loan and works in your favor. Because the boat secures the loan, lenders offer better interest rates than unsecured personal loans, making ownership more affordable.

Typical Loan Terms and Interest Rates

A surprise for many first-time buyers is the loan length. Surf boat financing terms often stretch for 15 to 20 years, sometimes longer for larger loans. These extended terms keep monthly payments manageable, making it easier to budget for a high-performance surf boat for your family’s lake trips.

Interest rates vary from 6% to 10% or more, based on your credit and the lender. Boat loans often have slightly higher rates than car loans since they’re considered recreational purchases. You can choose between fixed and variable rates. We recommend fixed rates to lock in your payment for the entire term, ensuring predictability for your trips on Lake Texoma or Table Rock Lake near Branson.

For example, financing a $150,000 surf boat over 20 years results in a much different monthly payment than a shorter-term loan, so it’s crucial to understand the structure before you sign.

Want to explore your rate options? Check out our Best Boat Loan Rates to see what might be available for your situation.

Down Payment and Monthly Payments

Most lenders expect a down payment of 10% to 20%. While “no money down” offers exist, a down payment typically secures better terms and lower monthly payments. It reduces the loan amount, provides immediate equity, and shows the lender you’re a serious buyer.

Lenders also review the loan-to-value (LTV) ratio, which compares the loan amount to the boat’s value. Most will finance 80% to 90% of the value, though some specialized marine lenders may go higher for qualified buyers.

Budgeting for your monthly payments is critical. Use a boat loan calculator before you start shopping. By inputting different loan amounts, rates, and terms, you can see how they affect your monthly payment. This lets you work backward from a comfortable monthly budget to determine a sensible total loan amount. Your boat should be a source of joy, not financial stress.

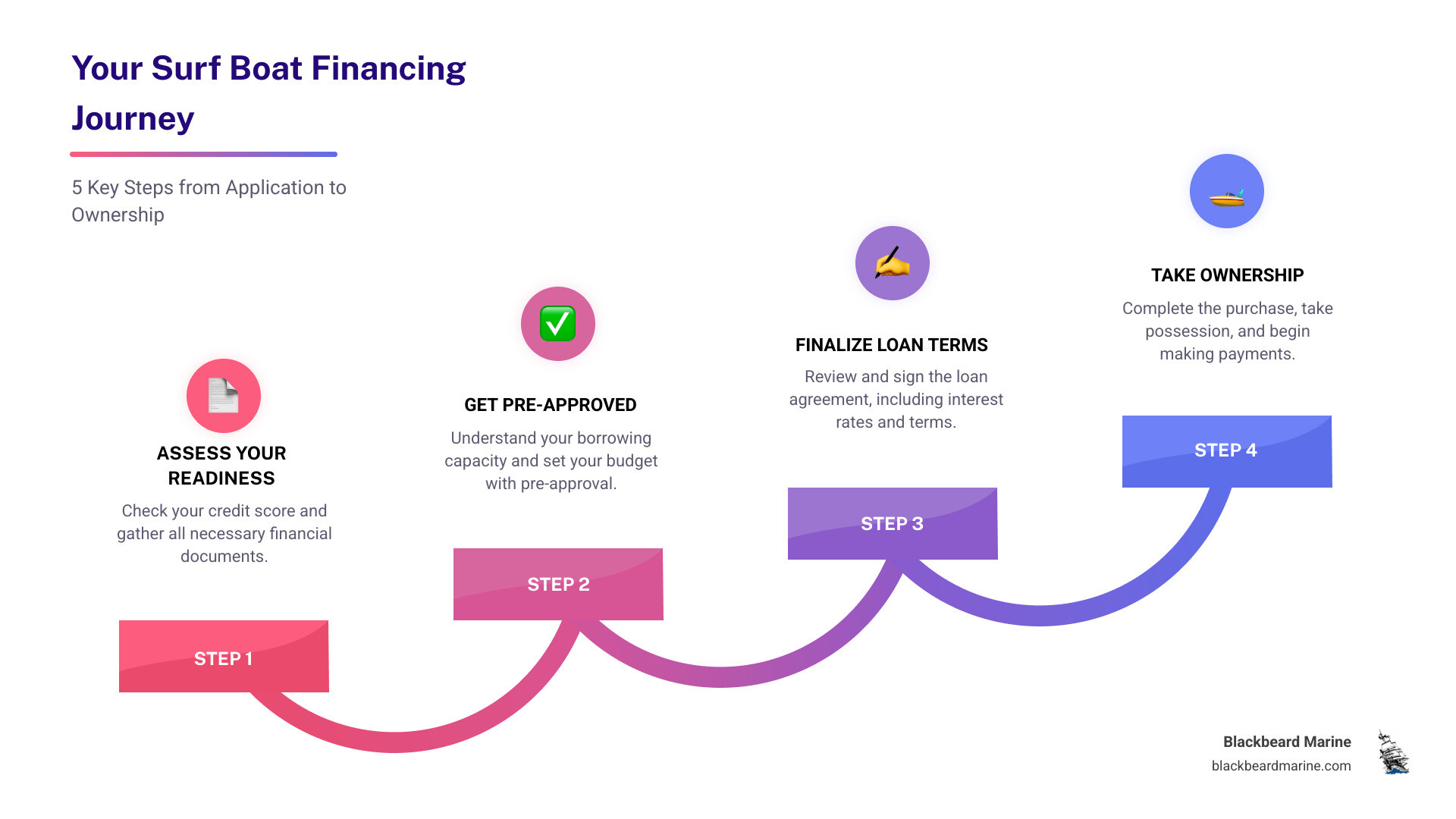

The Approval Process for Your Surf Boat Financing

Securing surf boat financing is an exciting step, but it involves lenders assessing your financial stability. They need to be confident you can make payments for the entire loan term. Getting pre-approved is a game-changer, as it clarifies your budget before you shop.

How Lenders Assess Your Application

When you apply for a surf boat loan, lenders will review key documents and consider these main factors:

- Credit History: Lenders review your payment history, current debt, and credit management history. A record of on-time payments is crucial.

- Debt-to-Income (DTI) Ratio: This compares your monthly debt payments to your income. Lenders prefer a DTI of 30-35% or lower, showing you can comfortably afford new payments.

- Employment Stability: A steady job and consistent work history indicate a reliable income.

- Boat’s Value and Type: Lenders check the boat’s value against the loan amount and consider the boat type, as a high-performance surf boat is assessed differently than a small fishing boat.

Lenders include banks, credit unions, and specialized marine lenders. At Blackbeard Marine, our network of trusted financial institutions helps us find the ideal financing solution for your needs. Knowing [How credit bureaus work](https://www.equifax.com/) can offer insight into what lenders see.

The Critical Role of Your Credit Score

Your credit score is critical for surf boat financing. It’s a financial report card that directly impacts your interest rates and terms. While some lenders accept scores of 600+, aiming for 700+ open ups the best rates and lower down payment options. Our preferred lenders at Blackbeard Marine often look for a credit score of 675 or higher. A great score can save you thousands in interest over the loan’s life.

A higher credit score shows lenders you’re a low-risk borrower, which can lead to:

- Lower Interest Rates: A better score means lower interest payments and a lower total cost.

- More Favorable Terms: You may qualify for longer terms or more flexible down payment options.

- Faster Approval: Great credit can significantly speed up the approval process.

We suggest checking your credit score before applying for surf boat financing. If it’s not ideal, you can improve it by paying debts on time and reducing credit utilization. Once you have the boat loan, timely payments can boost your score further if the lender reports to credit bureaus.

For [More info about our financing process](https://blackbeardmarine.com/boat-financing/), contact our team. We’re here to guide you.

Weighing Your Options: Financing vs. Paying Cash

Deciding how to pay for your surf boat is a major financial choice. While paying cash seems simple, surf boat financing offers strategic advantages for your overall financial health. Let’s compare the options.

| Feature | Financing a Surf Boat | Paying Cash for a Surf Boat |

|---|---|---|

| Initial Outlay | Lower (down payment only) | High (full purchase price) |

| Long-Term Cost | Higher (includes interest payments) | Lower (no interest) |

| Liquidity | Preserves cash for other investments or emergencies | Reduces cash reserves significantly |

| Credit Building | Can build or improve credit history | No impact on credit history |

| Opportunity Cost | Funds remain available for other opportunities | Funds are tied up in a depreciating asset |

| Access to Boats | Allows access to higher-value boats sooner | Limited to available cash |

The Pros and Cons of Financing a Surf Boat

Financing a high-value surf boat can be a smart move. It keeps your financial options flexible and opens up more possibilities.

Here are the top reasons many customers choose to finance:

- Preserving Cash: Financing keeps your savings and investments intact for emergencies, home renovations, or other opportunities.

- Building Credit History: Consistent, on-time payments on a boat loan can significantly boost your credit score.

- Access to Newer, Better Boats: Financing can help you afford a higher-quality, newer model like a Skeeter or Blazer Bay sooner than if you were saving to pay cash.

- Manageable Payments: Spreading the cost over many years creates predictable monthly payments that fit into your budget.

The main downside of financing is the higher total cost due to interest. You pay a premium for the flexibility of keeping your cash liquid, and over a 15 or 20-year term, interest adds up.

Risks of Long-Term Loans and Depreciation

It’s crucial to understand the full picture. Like cars, surf boats are depreciating assets, losing value over time, especially in the first few years. While a well-maintained Skeeter or Lowe holds its value well, your boat will likely be worth less than its purchase price in the future.

The biggest risk with long-term surf boat financing is ending up with negative equity, or owing more than the boat is worth. This becomes a problem if you need to sell before the loan is paid off, as you may have to pay the difference out-of-pocket. While some boats hold value well, losing only 15% in four years, it’s not guaranteed.

Another risk is rolling over negative equity from a trade-in. If your trade-in is worth less than the loan on it, some lenders let you add that difference to your new boat loan. This instantly puts you “upside down” on the new loan, creating a debt snowball that makes it harder to sell or trade in the future.

With loan terms up to 20 years, you could be making payments long after components need major repairs. Consider the total cost of ownership—including maintenance, storage, and insurance—not just the monthly payment.

For those dreaming of a Suncatcher pontoon boat for fun on Table Rock Lake, you can explore [Suncatcher Boats for Sale](https://blackbeardmarine.com/suncatcher-boats-for-sale/) on our site. Just remember to always consider the full financial picture before taking the plunge!

The Dealer’s Role and Specialized Financing Programs

When seeking surf boat financing, a dealership like Blackbeard Marine is an invaluable resource. We help guide the entire purchasing process, including securing the right loan.

Why Use Dealership Financing?

Dealership financing is like having a personal guide through the complex world of boat loans. At Blackbeard Marine, our experience helps customers avoid common pitfalls.

The biggest advantage is convenience—handling everything in one place. While you’re admiring a new Suncatcher pontoon or Skeeter bass boat, our finance team is working to secure your best loan options.

Our key advantage is our access to multiple lenders. We have relationships with banks, credit unions, and specialized marine lenders. This allows us to shop for the most competitive rates and flexible terms for you, acting as your expert marine loan broker.

Our finance managers provide expert guidance. They know the nuances of financing different boats, from a G3 fishing boat to a Blazer Bay bay boat, and can find creative solutions for nearly any credit situation.

Whether you visit us at Lake Texoma, Table Rock Lake in Branson, MO, or any of our [Our Locations](https://blackbeardmarine.com/our-locations/), you’ll receive this personalized service.

Understanding Add-Ons to Your Surf Boat Financing

Beyond the basic surf boat financing, you can roll various add-ons into your loan. These options can be beneficial but will increase your total loan amount and monthly payment.

- Extended warranties are common and provide peace of mind for complex surf boats, though you’ll finance the cost over the loan term.

- Credit protection plans can cover payments in case of job loss or disability, offering a financial safety net.

- GAP insurance is highly recommended. It covers the “gap” between what you owe and the boat’s insured value if it’s totaled or stolen—critical since you could be “upside down” for years.

- Bundling accessories, like a premium electronics package for your Lowe fishing boat or a trailer, can often be included in your loan.

The key is to understand how each add-on affects your bottom line. Our finance team explains the true cost of each option, including total interest paid, so you can make an informed decision.

Ready to see what’s available? [View our current inventory](https://blackbeardmarine.com/inventory/) of Suncatcher, G3, Lowe, Seaark, Skeeter, and Blazer Bay boats.

Frequently Asked Questions about Surf Boat Loans

It’s natural to have questions about surf boat financing. Having helped many families at our Lake Texoma and Table Rock Lake locations, we’ve compiled the most common questions with honest answers to help you make the best decision.

Can I get a boat loan for a term longer than the boat’s expected lifespan?

Yes, and it’s quite common in surf boat financing, especially for high-end models like a Suncatcher pontoon or Skeeter bass boat. Lenders offer terms of 15 to 20 years, sometimes longer, to make monthly payments manageable. The term is based on affordability, not the boat’s lifespan. This structure helps more families get on the water and spreads the lender’s risk over time as the boat depreciates.

The trade-off is that lower monthly payments mean paying significantly more interest over the loan’s life. You may also be making payments on an aging boat that requires more maintenance.

Are there tax benefits to financing a surf boat?

In some cases, your boat loan interest may be tax-deductible. If your boat qualifies as a second home by having a galley (kitchen), a head (toilet), and a sleeping berth, you may be able to deduct the interest. Many larger Suncatcher and Lowe models we sell have these features.

This can lead to substantial savings, but tax laws are complex and personal. We strongly advise consulting a qualified tax professional to see if this benefit applies to you before making a financing decision based on potential tax benefits.

What happens if I roll negative equity from a trade-in into my new boat loan?

This happens when your trade-in is worth less than the outstanding loan balance. Some lenders let you roll this negative equity into your new surf boat financing. However, this means you start your new loan “underwater,” owing more than your new Skeeter or Seaark is worth.

This increases your loan-to-value ratio and can create problems if you need to sell or trade the boat later, potentially requiring you to pay out-of-pocket to cover the difference. While it might seem like an easy way to get into that new G3 you’ve been eyeing, we recommend exploring other options to avoid carrying that debt forward. Our finance team at Blackbeard Marine can help you find alternatives that won’t put you in a difficult financial position.

Conclusion

Navigating surf boat financing can seem complex, but with the right information, you can proceed with confidence. We’ve covered loan terms, interest rates, the importance of your credit score, financing vs. cash, and the risks of long-term loans and depreciation.

A dealership like Blackbeard Marine is your partner, offering specialized financing programs and explaining all your options, including protective add-ons. The dream of owning a Suncatcher, G3, Lowe, Seaark, Skeeter, or Blazer Bay on Table Rock Lake or Lake Texoma is within reach. Understanding these financial details empowers you to make a smart choice that fits your budget and gets you on the water sooner.

At Blackbeard Marine, we are passionate about helping you find the perfect boat and the perfect financing plan. We believe in transparency, giving you the facts needed to make the best decision for your family.

Don’t let financing details hold you back from your boating dream. Our team is ready to help you steer the process.

[Contact our boat financing experts today to get pre-approved!](https://blackbeardmarine.com/boat-financing/) Let’s turn those lake day dreams into a splashing reality!